Blog

Forex Trading for Day Traders: Maximizing Profits in Short Timeframes

Forex trading offers various opportunities for traders to profit from currency fluctuations, and one popular approach is day trading. Day trading inv

Read More

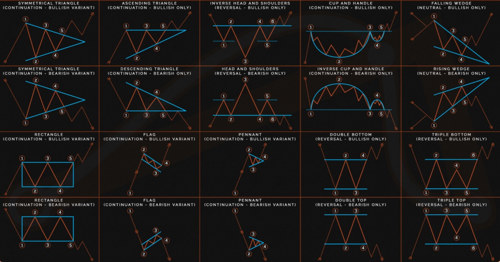

Mastering Forex Chart Patterns: A Guide to Continuation Patterns, Risk Management, and Price Movements

Forex chart patterns are powerful tools that traders use to analyze price movements and make informed trading decisions. In this article, We will expl

Read More

Artificial Intelligence Price Prediction: Shaping the Future of Markets

The crypto market has undergone tremendous growth in recent years, attracting investors and traders from around the globe. As the industry matures

Read More

Forex Trading for Busy Professionals: Strategies for Time-Efficient Trading

In today's fast-paced world, many professionals find themselves juggling multiple responsibilities and limited time for activities outside of their wo

Read More

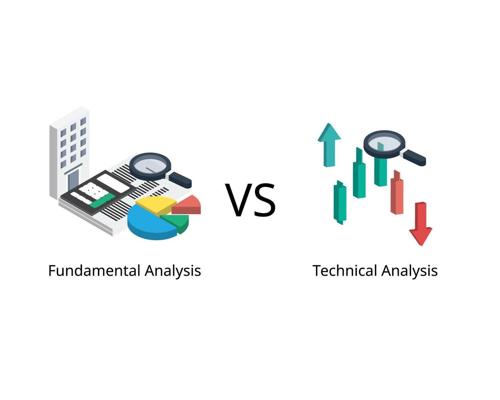

Mastering Forex Analysis: Fundamental vs. Technical Analysis

When it comes to stock picking, there are two main schools of thought: fundamental analysis and technical analysis. Fundamental analysts evaluate a

Read More

Rise of Robo-Advisers

Robo-advisors are rapidly gaining popularity among investors as a new and innovative way to invest their money. These AI-powered investment platforms

Read More

How AI is Changing the Way We Invest?

Artificial intelligence (AI) has made significant advancements in the world of finance, particularly in the area of financial administration, in recen

Read More

Decreasing Risk Factor with Funds

Any investment plan that aims to reduce risk and accomplish long-term financial objectives must include investing in funds. Funds are a great option

Read More